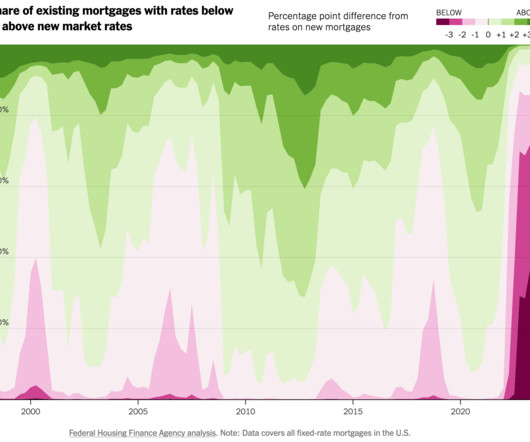

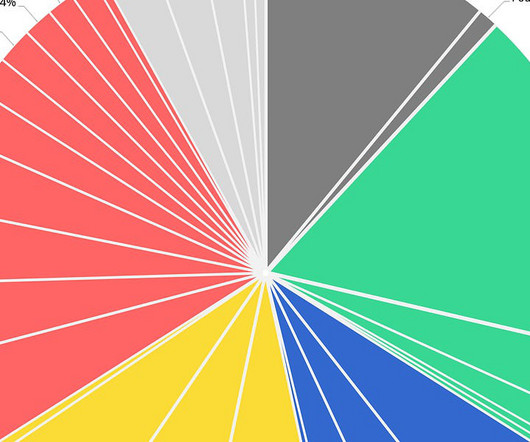

Existing mortgages with lower rates than new ones

FlowingData

APRIL 19, 2024

For The Upshot, Emily Badger and Francesca Paris compare the rates of existing mortgages against current rates for new loans. Higher mortgage rates, higher listing prices, and higher property taxes. Higher mortgage rates, higher listing prices, and higher property taxes. Tags: mortgage , Upshot Doesn’t seem fun.

Let's personalize your content