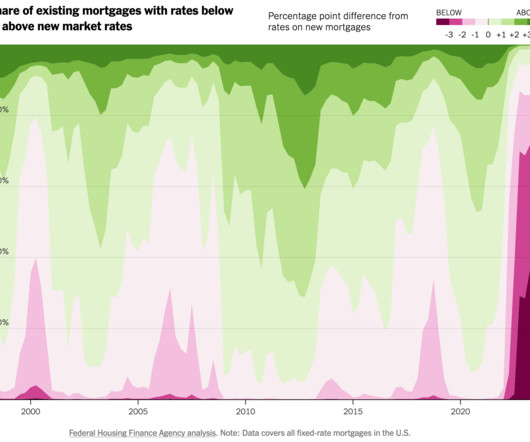

Existing mortgages with lower rates than new ones

FlowingData

APRIL 19, 2024

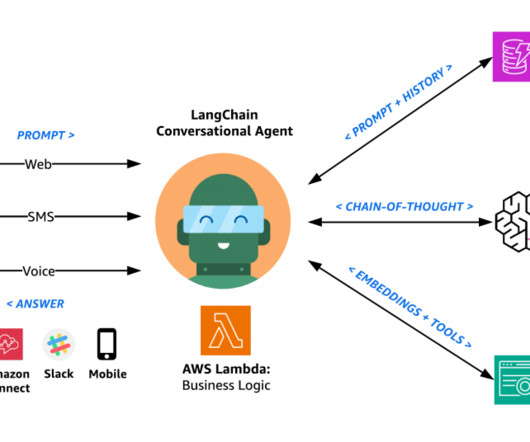

For The Upshot, Emily Badger and Francesca Paris compare the rates of existing mortgages against current rates for new loans. A stacked area chart shows the large share of existing rates that are lower, which means a lot of people aren’t so eager to move, relative to the past 20 years. Doesn’t seem fun.

Let's personalize your content