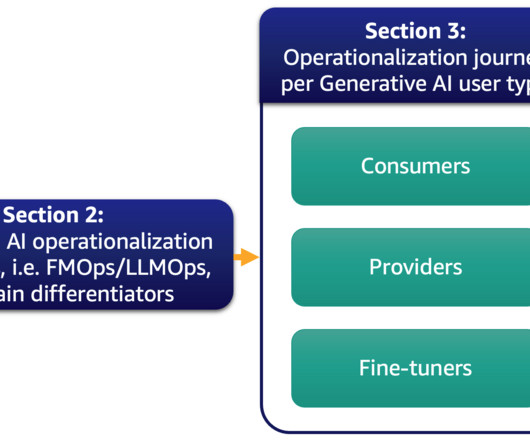

Harnessing the Capabilities of Gen AI for Unprecedented Impact and Effortless Integration

insideBIGDATA

FEBRUARY 23, 2024

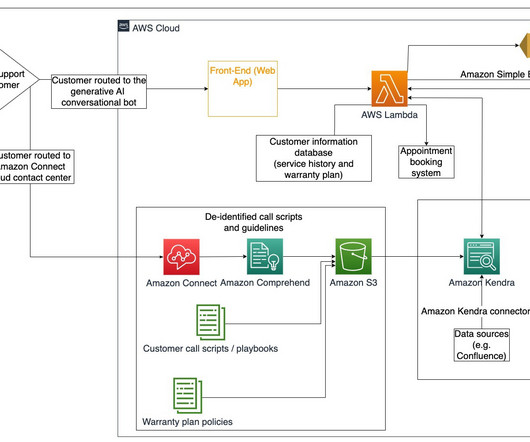

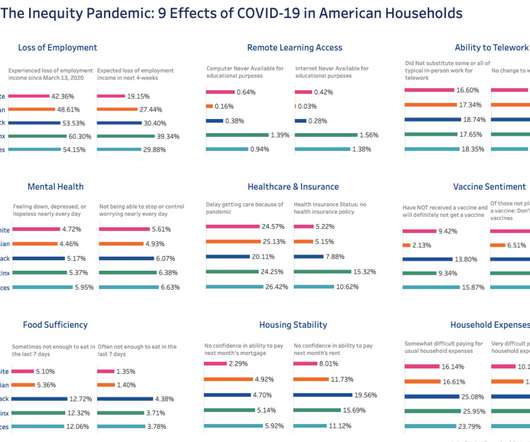

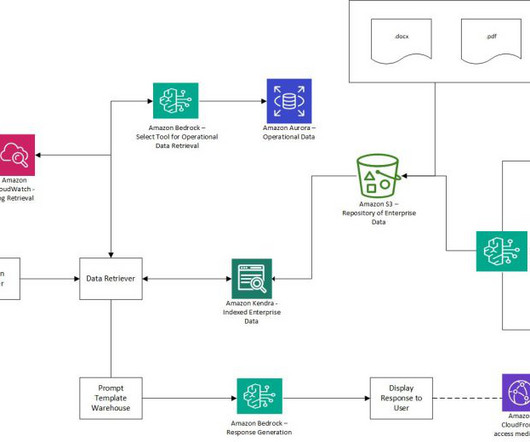

In this contributed article, Ajay Kumar, CEO at SLK Software, discusses how generative AI provides unprecedented impact and effortless integration for the banking, insurance, and manufacturing industries.

Let's personalize your content