Meet Predictoor: Accountable Accurate Prediction Feeds

With application to finance, weather, climate, real estate, and more. Powered by Ocean Protocol [a member of ASI Alliance]

Contents

1. Motivation

2. Introduction to Predictoor

- Overview, structure, behavior

3. Predictoor Parameters

- Roadmap, feeds published, pricing

4. How to Earn

- As a predictoor, trader, or data farmer

- From earning to thriving; early benchmarks

5. Architecture

- Privacy & Oasis Sapphire

- Implementation, backend, testnet, mainnet

6. Possible Futures

7. Conclusion

Appendix: Predictoor Data Farming

Appendix: Q&A. Relation to prediction markets, NumeraiSummary

Prediction is intelligence, artificial or otherwise. We dream of a world of 10,000 truly accurate prediction feeds, for everything from rain forecasts to sea level rise, or traffic congestion to ETH price. Ocean Predictoor is an on-chain, privacy-enabled, AI-powered application and stack that is bringing this dream to reality. Its testnet is live as of Sep 12, mainnet as of Oct 10, and incentives program as of Nov 9, 2023.

Key links: tweetstorm, Dappcon talk [video][GSlides][PDF]

1. Motivation

Tomorrow belongs to those who can hear it coming. — David Bowie

Accurate predictions are valuable. With them, one can take action and create value. Conversely, inaccurate predictions can be problematic. Predictions have value because they’re the final step in a data supply chain, right before action is taken by the user.

Prediction feeds are a stream of predictions for a given time series. This could be predicting the price of ETH every 5 minutes, or the sea temperature daily. A feed may be binary, i.e. whether a time series changes up or down: ↑↓↓↓↑↓↑↑. Accurate prediction feeds are valuable.

Alas, accurate predictions are *hard*. Worse, typical prediction feeds have no accountability on accuracy. If the weatherman says “no rain for today” and then it rains, a farmer could get stuck in the mud, wrecking a portion of his crops. The weatherman doesn’t feel the impact of wrong predictions, but the farmers sure care!

Imagine if there was accountability. Accuracy would go up; the farmer would be stuck less. Imagine accountable prediction feeds for not only for rain, but also wind, sea temperature, road congestion, train delays, ETH prices, NVID prices, housing prices, and more. Imagine tens of thousands of prediction feeds with accountable accuracy. Imagine them globally distributed, and censorship resistant. Imagine accuracy improving with time.

This is the dream, that became a goal, that got built. This is Ocean Predictoor.

2. Introduction to Predictoor

Yesterday is gone. Tomorrow has not yet come. We have only today. Let us begin. — A mother

2.1 What is Predictoor?

Ocean Predictoor is a dapp and a stack for prediction feeds. It has accountability for accuracy, via staking. It’s globally distributed and censorship-resistant, by being on-chain. We expect its accuracy to improve over time, due to its incentive structure. Its first use case is DeFi token prediction because users can close the data value-creation loop quickly to make tangible $.

Prediction feeds are crowd-sourced. “Predictoor” agents submit individual predictions and stake on them. They make money when they’re correct and lose money when not. This drives accurate prediction feeds, because only accurate predictoors will be making $ and sticking around.

“Trader” agents buy aggregate predictions, then use them to take action like buying or selling. The more accurate the predictions, the more easily they make $, the longer they stick around to keep buying prediction feeds from trading profits.

Predictoor is built on the Ocean Protocol stack, including contracts for tokenized data and middleware to cache metadata. To keep predictions private unless paid for, Predictoor uses Oasis Sapphire privacy-preserving EVM chain.

The dapp is live at predictoor.ai (mainnet) and test.predictoor.ai (testnet). It’s for up/down predictions of BTC, ETH, and other tokens’ prices. The dapp helps users build a mental model of Predictoor behavior. Predictoors and traders’ main workflow is to do run predicting / trading bots with the help of the Py SDK. We have seeded Predictoor with bots that have AI/ML models of accuracy comfortably above 50% — a precondition to make $ trading [0].

2.2 Predictoor Structure

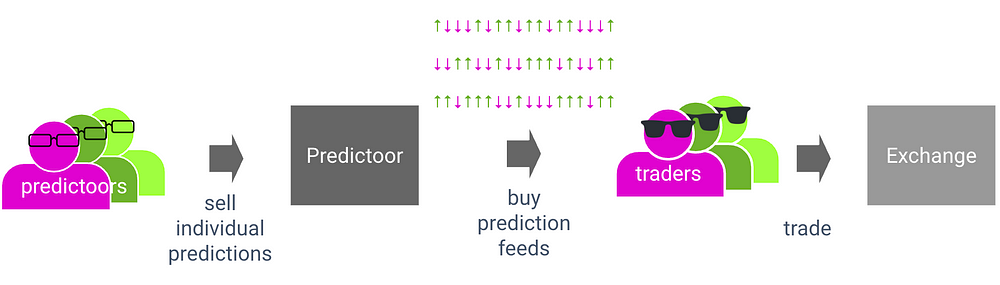

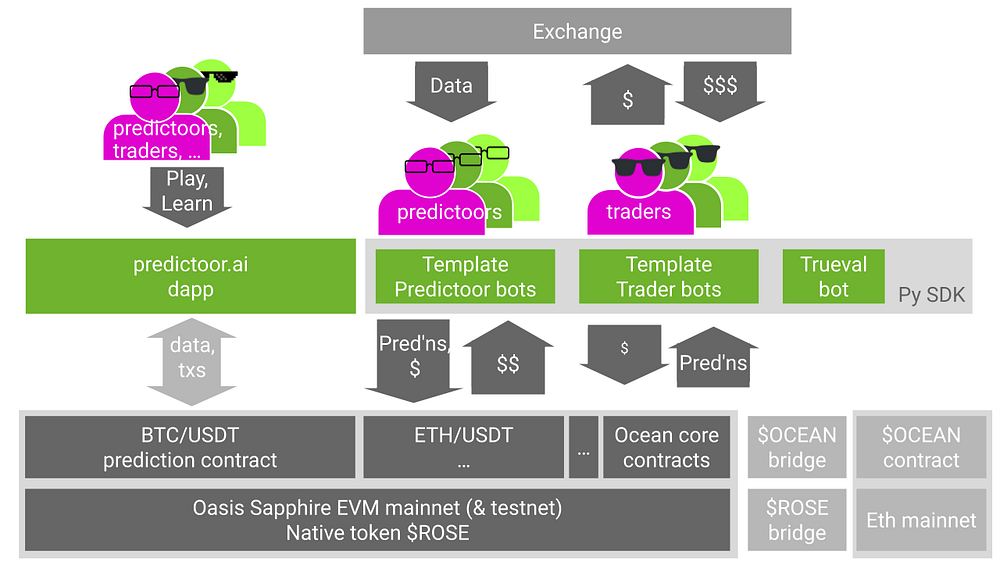

The image below gives an overview of Predictoor structure.

In the image top left, predictoors, traders, or anyone play with predictoor.ai to build an understanding how predictoor works. One feed is free; the rest are available for purchase. At first, only the free feed is visible. Users can connect their web3 wallet and buy another feed.

In the image top middle, predictoors graduate to building & deploying Python “Template Predictoor bots” (agents), which submit predictions every 5 minutes. Now, predictoors can see how to make $ from making predictions, with plenty of room to improve AI/ML modeling accuracy and make more $.

In the image top right, traders graduate from predictoor.ai to building & deploying Python “Template Trader bots” (agents), which grab the latest prediction every 5 minutes, as soon as it’s available, then trade using that prediction (and other info). Now, Traders can see how to make $ from buying predictions, with plenty of room to improve trading strategy and make more $.

In the image bottom is the Oasis Sapphire chain, with Predictoor feed contracts deployed to it. There’s one contract deployed for each {pair, exchange, timescale} such as {ETH/USDT, Binance, 5m}.

2.3 Predictoor Behavior

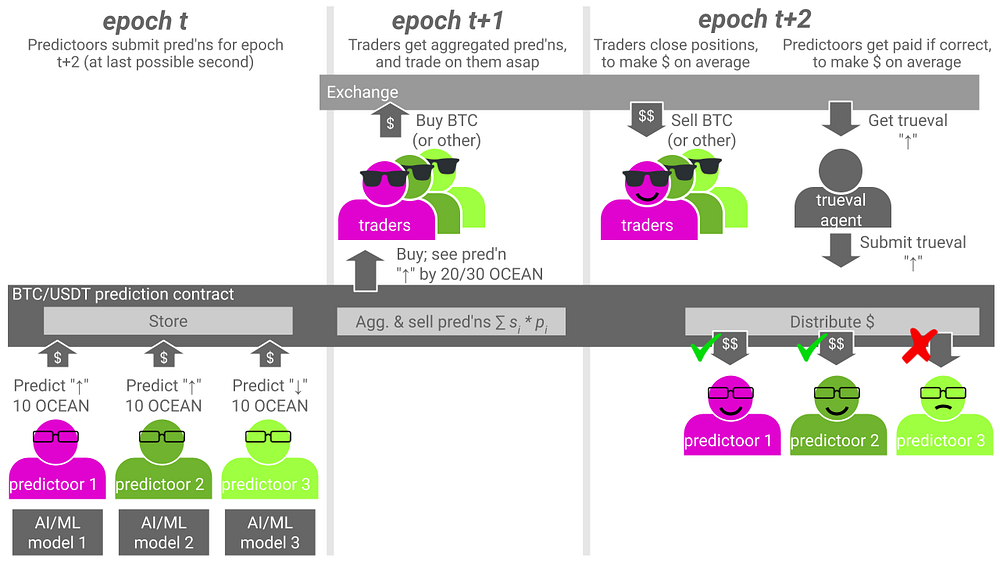

We just covered Predictoor structure. Let’s now layer on some Predictoor behavior, with the help of the image below. We’ll walk through actions by Predictoors and Traders related to predictions for time slot “epoch t+1”, and show how they make $.

We assume predictions on BTC, and where epoch t ends at 5:00pm, t+1 ends 5:05pm, and t+2 ends 5:10pm. We assume that Traders already purchased a subscription via predictoor.ai, Python, or otherwise. When we discuss an action by a Predictoor or Trader, we recognize that it’s typically executed by their agent (bot).

Epoch t. This is left 1/3 of the image. It starts at 4:55pm and ends at 5:00pm. Predictoor 1 (pink) predicts that BTC close price for epoch t+1 will be higher (“↑”) than close price for epoch t. He submits a tx to that chain with that prediction, and some OCEAN stake of his choice (higher stake = more confident). Predictoor 2 (dark green) does the same. Predictoor 3 (light green) predicts “↓” and stakes. The chain stores these prediction values, privately.

Epoch t+1. The middle 1/3 of the image covers epoch t+1. It starts at 5:00pm and ends at 5:05pm. The BTC Predictoor contract computes the aggregated predicted value (agg_predval) as stake-weighted sum across individual predictions.

agg_predval = (stake1*predval1 + stake2*predval2 + …) / (stake1 + stake2 + …)

The contract then makes agg_predval visible to its subscribers. The predicted value is the stake-weighted sum across predictions. Smart traders may take the information and act immediately. A baseline strategy is “if it predicts ↑ then buy; if it predicts ↓ then sell or short”.

Epoch t+2. This is the right 1/3 of the image. It starts at 5:05pm and ends at 5:10pm. Both traders and trueval agent take action (and, predictoors get paid).

- Actions by Traders. Typically, traders exit their position immediately, exactly 5 minutes since they got the 5-minute-ahead prediction and acted [1]. If the prediction feed was accurate enough and trading fees & slippage weren’t too high, then the trader makes money on average.

- Actions by Trueval agent; predictoors get paid. The trueval agent is a process that grabs price feeds from e.g. Binance and submits it to chain, inside the smart contract [2]. The “submit” transaction also takes the opportunity to calculate each Predictoor’s reward or slashing, and update their OCEAN holdings in the contract accordingly. (Funds aren’t sent per se, they’re made available via ERC20 “approve”, for the predictoor to transfer at some later point). Predictoor 3 got his OCEAN slashed because he was wrong; predictoors 1 and 2 receive that as income, in addition to receiving income from prediction feed sales to traders. Predictoors can claim their balance anytime.

3. Predictoor Parameters

3.1 Roadmap

Predictoor will roll out in three phases: Testnet → Mainnet → Data Farming.

- Tue Sep 12, 2023: Predictoor Testnet is ready for community. This means Ocean Predictoor smart contracts, middleware, and frontend running on Oasis Sapphire testnet. 5min feeds.

- Tue Oct 10 [4w later]: Predictoor Mainnet is ready for community. It uses Oasis Sapphire mainnet. Tokens have real value. OCEAN bridges from Eth mainnet via Celer. 5min + 60min feeds.

- Thu Nov 9 [4w 2d later]: Predictoor Data Farming starts counting. There will be $thousands worth of OCEAN and ROSE, as weekly rewards to incentivize predictoors. The appendix has details.

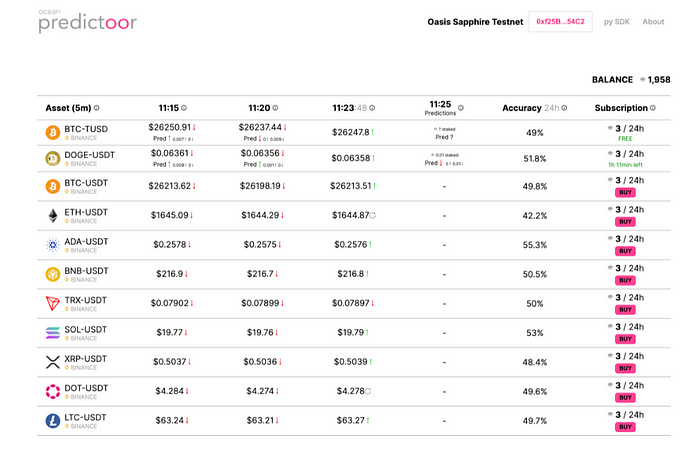

3.2 Feeds Published

For both testnet and mainnet, there are 20 feeds:

- X/USDT pair for each of the top-10 coins by market cap (ignoring stablecoins), on Binance, 5m timescales. The coins are: X = BTC, ETH, BNB, XRP, ADA, DOGE, SOL, LTC, TRX, DOT

- Like above, but for 60m timescales

3.3 Pricing

For each timescale, one feed is free: BTC/UTD on Binance. Below is pricing for the remaining feeds.

The price to subscribe to one feed for 24 hours is 3.00 OCEAN. This includes all fees.

Fee details:

- 0.1% community swap fee

- 20% fee to Ocean Protocol Foundation. (Will be used to further drive Predictoor, and to burn OCEAN.)

- For reference, price without fees is 2.49791840133 OCEAN. To calculate this: Let x = price without fees. Then x * (1 + 0.20 + 0.001) = 3.0 → x = 3.0 / (1 + 0.20 + 0.001) = 2.49791840133

Pricing is subject to change based on learnings, and feedback from community.

4. How to Earn

4.1 How to Earn as a Predictoor

If you have background in AI, ML, data science or statistics (and these overlap!) then you’re well suited to become a predictoor to make $.

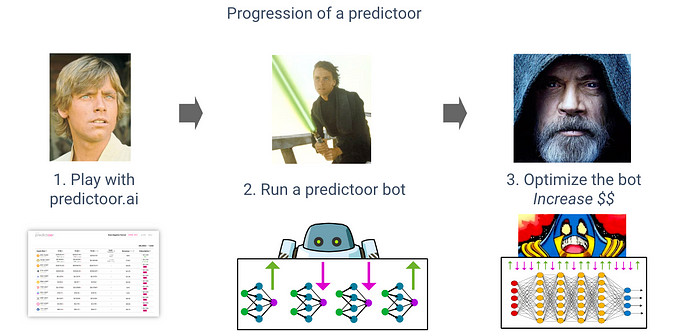

Typical steps as a predictoor:

- Play with predictoor.ai. Go to predictoor.ai to build intuition: observe the free feed, perhaps buy a few feeds, and watch them change over time.

- Run a predictoor bot. Follow the steps in the Predictoor README. You’ll start by running simulations with AI-powered predictions. Then you’ll run a predictoor bot on a remote testnet staking fake OCEAN. Finally, you’ll do it on mainnet staking real OCEAN.

- Optimize the bot. Improve model prediction accuracy via more data and better algorithms. Extend to predict >1 prediction feeds (Predictoor has many). Wash, rinse, repeat.

The actions as a predictoor give the following ways to earn:

- Feed sales. At an epoch, sales revenue (minus fees) for that epoch goes to predictoors. It’s distributed pro-rata by stake among the predictoors who predicted the true value correctly. The revenue for an epoch is the fraction of sales, spread uniformly across subscription length. A price of 3 OCEAN, 5m epochs, and 24h (1440m) subscriptions gives a revenue of (# subscribers) * (3 OCEAN) * / (1440m / 5m).

- Stake reshuffling. At an epoch, incorrect predictoors have their stake slashed. This slashed stake is distributed to the correct predictoors pro-rata on their stake.

- Predictoor DF. The third phase of Predictoor rollout will have an incentives program that amounts to additional earning for predictoors. Initially it will be 37,000 OCEAN/week rewards, and +100,000 ROSE/week rewards. These numbers will likely evolve over time.

Don’t expect to be 100% accurate in your up/down predictions. Marginally better than 50% might be enough, and be skeptical if you’re greatly above 50%, you probably have a bug in your testing.

Predictoors can earn even more, via complementary actions:

- Passive DF & Volume DF. Lock veOCEAN for OCEAN, then point the veOCEAN to data assets with high data consume volume (DCV). Predictoor feeds are great candidates for high-DCV assets.

Every week there’s 150,000 total OCEAN rewards for Ocean Data Farming. This will increase in early 2024, and more yet later. Here are details.

⚠️ You will lose money as a predictoor if your $ out exceeds your $ in. If you have low accuracy you’ll have your stake slashed a lot. Do account for gas fees, compute costs, and more. Everything you do is your responsibility, at your discretion. None of this blog is financial advice.

4.2 How to Earn as a Trader

You can make $ by buying prediction feeds, and using it as an input — as “alpha” — to your trading approach.

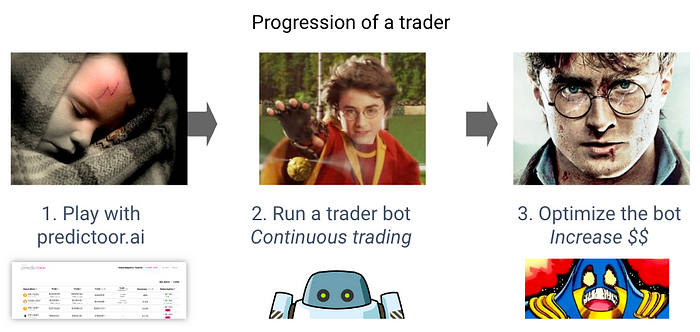

Typical steps:

- Play with dapp, and trade. First, go to predictoor.ai to build intuition: observe the free feed, perhaps buy a few feeds, and watch them change over time. In a second window, have Binance open. Employ a baseline trading strategy: when a new Predictoor prediction pops in, buy if “↑”, and sell or short if “↓”; exit the position 5 min later.

- Run a trader bot. Follow the steps in the Trader README. You’ll start by running simulations with AI-powered predictions. It follows the baseline trading strategy: when a new Predictoor prediction pops in, it buys if “↑”, and sells if “↓”. Then you’ll do run a trader bot on a remote testnet with fake tokens. Finally, you’ll do it on mainnet with real tokens on a real exchange.

- Improve & extend. Improve trading performance via more sophisticated trading strategies. This is a universe all of its own! Extend to >1 prediction feeds (Predictoor has many). Wash, rinse, repeat.

The actions as a trader offer a single yet powerful way to earn: trading revenue. Buy low and sell high! (And the opposite with shorting.)

Traders can earn even more via a complementary action: Volume DF. Lock veOCEAN for OCEAN, then point the veOCEAN to data assets with high DCV. Predictoor feeds are great candidates for high-DCV assets.

⚠️ You will lose money trading if your $ out exceeds your $ in. Do account for trading fees, order book slippage, cost of prediction feeds, and more. Everything you do is your responsibility, at your discretion. None of this blog is financial advice.

4.3 How to Earn as a Data Farmer

Even if you’re not active as a predictoor or a trader, you can earn nonetheless. By simply locking your OCEAN for veOCEAN, you can earn passive rewards. Moreover, if you point your veOCEAN to data assets that have high data consume volume (Predictoor assets are a good choice), then you can earn “Volume DF” active rewards.

4.4 From Earning, to Thriving (Why Predictoor)

Why did we, at Ocean Protocol, build Predictoor? Why did we structure it around predictions, for predictoors and traders to earn? Can earning grow into thriving? We explain here.

Ocean Protocol’s mission is to level the playing field for data and AI, by kickstarting an open data economy. We’ve asked: How do people sustain and thrive in the emerging open data economy? Our answer is simple: ensure that they can make money!

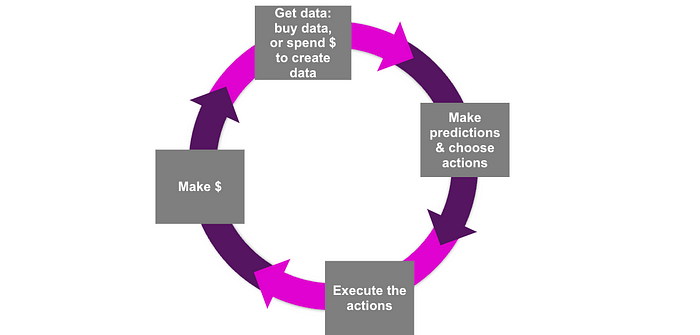

However, this isn’t enough. We need to dive deeper. The next question is: How do people make money in the open data economy? Our answer is: create value from data, make money from that value, and loop back and reinvest this value creation into further growth. We call this the Data Value-Creation Loop.

If we unroll the loop, we get a data value supply chain. In most supply chains, the most value creation is at the last step, right before the action is taken. Would you rather a farmer in Costa Rica selling a sack of coffee beans for $5, or Starbucks selling 5 beans’ worth of coffee for $5? It’s the same for data. For data value supply chains, the most value creation in the prediction step.

Predictoor is a direct manifestation to make this happen. Predictoor aims to make it easy for people to make $ doing predictions (as predictoors), and taking actions against those predictions (as traders). If traders make $ with sufficiently accurate feeds, then they’ll keep buying the feeds, and then the predictoors will make $. As the predictoors pursue higher accuracy, they’ll buy their own data feeds, ie working backwards in the data supply chain. Over time, the whole data supply chain will flesh out with $ at each step.

And the starting point is predictions.

4.5. Early Earnings Benchmarks

As discussed, Predictoor aims to make it easy for people to make $ doing predictions (as predictoors), and taking actions against those predictions (as traders).

Before we started building Predictoor, we first asked: can we predict ETH (etc) up/down with accuracy? Then we conducted intensive AI/ML research towards this question. The results of this investigation were positive 😎. TBH, we were surprised at the degree of market inefficiency.

Our next question was: with these predictions, can we make $ trading? Again, we conducted intensive AI/ML research, and again found positive results 😎😎.

Here we share some results of that research — a glimpse of how deep the rabbit hole goes — to inspire would-be predictoors and traders in their own work. The model was trained on data from January 1, 2021 to June 30, 2023, with simulated results the first 24 days of July 2023. A “baseline” trading strategy was used: “if it predicts ↑ then buy; if it predicts ↓ then sell or short”.

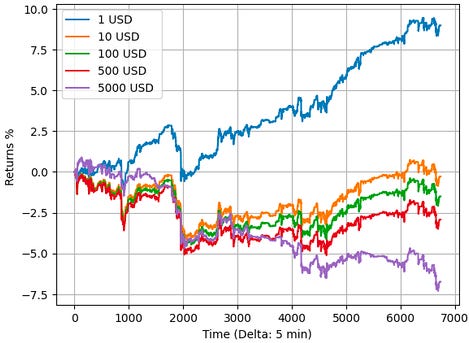

The image below shows simulated returns as a function of order size, for BTC/TUSD on Binance. Duration = 7000 ticks x 5m/tick = 24.3 days of trading. It simulates spread effects. It assumes 0% fees. Note how the size of the order affects the return. This is because BTC/TUSD is not very liquid; therefore larger amounts cause slippage.

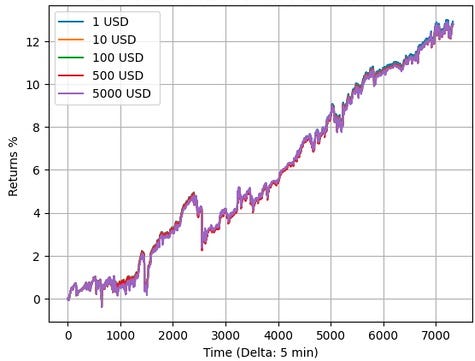

The image below has the same experimental setup, but for BTC/USDT pair. The size of the order does not affect the return, because BTC/USDT is more liquid than BTC/TUSD.

5. Predictoor Architecture

5.1 Privacy and Oasis Sapphire

Predictoor needs privacy for:

- Submitted predictions

- Compute aggregate predictions; and

- Aggregated predictions — only subscribers can see

This could all be done on fully-centralized infrastructure. But doing so would fail on our other goals: being globally distributed, censorship resistant, and non-custodial.

Targeting these needs, we researched & prototyped many privacy technologies. Oasis Sapphire emerged as the best choice because, as the only privacy-preserving EVM chain in production, it could handle these needs cleanly end-to-end.

5.2 Software Implementation

Most of predictoor.ai dapp is implemented in the pdr-web repo, with help from pdr-websocket to fetch feed data and Ocean Aquarius for metadata caching.

The template Predictoor bots, trader bots, trueval bot, and prediction feed publishing are all in the pdr-backend repo. Contracts are in the Ocean contracts repo.

Events emitted by contracts are indexed as Ocean subgraphs, to be consumed by predictoor.ai and the bots. The backend subgraph README has more info.

5.3 Backend & Contract Details

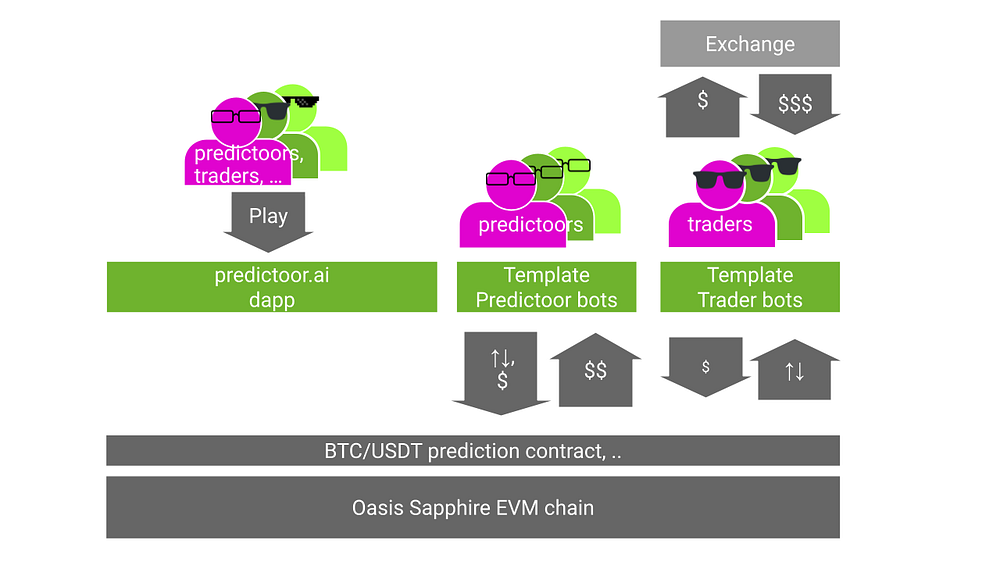

The image “Overview of Predictoor structure” presented earlier showed much of the Predictoor architecture. The image below adds detail around the backend (bottom 1/3 of diagram). Let’s discuss.

Smart Contracts. There’s one Predictoor contract for each prediction feed, at each exchange/timescale: BTC/USDT at Binance/5m, ETH/USDT at Binance/5m, and so on. Each contract is an Ocean datatoken contract, with a new template for prediction feeds [3]. It implements ERC20, Ocean, and Predictoor-specific behavior as follows.

- ERC20 behavior. It implements the ERC20 interface and therefore plays well with ERC20-friendly crypto wallets, DEXes, etc.

- Ocean behavior. Being part of Ocean, having 1.0 datatokens means you can access the underlying data asset for the duration of the subscription (once you’ve initiated the order). For Predictoor contracts this is 24h. Each datatoken contract has a parent Ocean data NFT with metadata, means to specify & collect fees, and more.

- Predictoor behavior. Each datatoken contract has additional methods specific to Predictoor: submitting predictions, submitting truevals, computing aggregated predictions, etc.

5.4 Testnet Details

As of Sep 12, 2023, Predictoor / Ocean contracts are deployed to Oasis Sapphire testnet.

Users need fake OCEAN & ROSE tokens:

- Fake OCEAN. Staking & payment is in fake OCEAN. Users acquire it via a faucet.

- Fake ROSE. Gas fees are in fake ROSE. Users acquire it via a faucet.

5.5 Mainnet Details

As of Oct 10, 2023, Predictoor / Ocean contracts are deployed to Oasis Sapphire mainnet.

Users need (real) OCEAN & ROSE tokens:

- OCEAN. Staking & payment is in OCEAN. Users acquire OCEAN via exchanges. Users bridge OCEAN tokens from ETH mainnet to Oasis Sapphire mainnet via Celer.

- ROSE. Gas fees are in ROSE. Users bridge tokens bridge from Oasis Emerald mainnet to Oasis Sapphire mainnet via Celer. [Details]

6. Possible Futures

This first release of Predictoor is just the beginning. We anticipate adding many more crypto feeds: more coins, more exchanges (CEX and DEX), more timescales; and predictions beyond just coin prices.

We envision the Predictoor stack being used in other verticals like real estate, weather, climate, transportation, and agriculture. We envision refinements of the core Predictoor technology.

Predictoor’s predictions are the final step of the web3 data value creation pipeline, right before action is taken and $ is made. We anticipate that the $ made by Predictoors will filter upstream, into work to create feeds used by Predictoors, such as sentiment analysis, volatility, and information ticks.

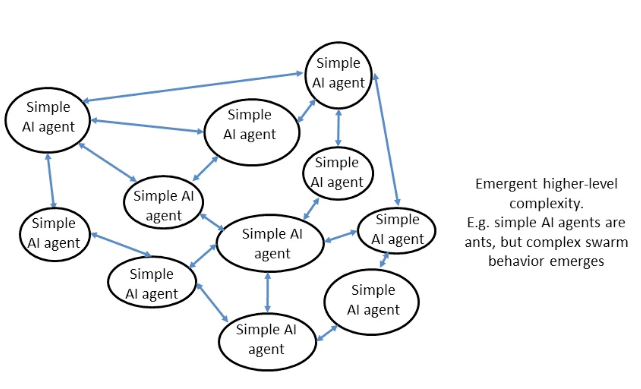

More interestingly, the agents of the Predictoor ecosystem may evolve. Starting as relatively simple agents running on the centralized cloud, Predictoor’s incentives can drive them to becoming decentralized and autonomous, while performing AI. Yes, AI DAOs. Swarms of sovereign agents: some predicting, some trading, and some providing support services along the data supply chain. It will feel a bit like nature, a bit out of control, and wholly exciting!

Most interestingly yet, Predictoor is a path to vastly more powerful AI. once there are 10K+ feeds backed by ground-truth physics, we can build a single AI model across all feeds 🤯.

7. Conclusion

We can only see a short distance ahead, but we can see plenty there that needs to be done.

— Alan Turing

We dream of a world of 10,000 truly accurate prediction feeds, for everything from rain forecasts to sea level rise, or traffic congestion to ETH price. Ocean Predictoor is an on-chain, privacy-enabled, AI-powered application and stack that is bringing this dream to reality.

Predictoor’s testnet is live now, mainnet soon, and incentives program soon after. We anticipate Predictoor to extend beyond DeFi to other verticals like climate and agriculture. Predictoor agents may evolve into AI DAOs with emergent swarm-like behavior. This is the future.

To read more: Predictoor docs, all Predictoor blog posts.

Appendix: Predictoor Data Farming

Data Farming (DF) is Ocean Protocol’s core incentive program that rewards participants to onboard the protocol and create value by using tools that help grow it further. Data Farming participants earn OCEAN rewards across two streams: Passive DF (for passive rewards) and Active DF. (rewards for active contributions). Active DF has several substreams.

Predictoor Data Farming is a new substream of Active Data Farming. It amplifies existing predictoors’ earnings based on their accuracy and stake. It does so by basically contributing extra sales to Ocean Predictoor data feeds. Let’s dive in!

Summary:

- Counting for Predictoor Data Farming starts Nov 9, 2023

- Initially, there will be 37,000 OCEAN and 100,000 ROSE weekly rewards to incentivize predictoors. These numbers will likely evolve over time.

For details, please see “Introducing Predictoor Data Farming” at the Ocean blog.

Appendix: Q&A

Relation to Prediction Markets

Q: How does Predictoor compare to prediction markets? Like Predictoor, they use $ for accountability.

A: They’re different:

- Prediction markets are for one-off predictions like “will Biden win in 2024?”

- Whereas Predictoor-style prediction feeds are for a continuous stream of predictions.

Relation to Chainlink

Q: How does Predictoor compare to Chainlink? Like Predictoor, it has price feeds on-chain.

A: They’re different. Chainlink provides current prices on-chain, and Predictoor makes predictions for prices in the future.

Relation to Numerai

Q: How does Predictoor compare to Numerai? Like Predictoor, it crowd-sources predictions, related to trading.

A: They’re different:

- Numerai takes predictions, then aggregates them and uses them to trade directly. It operates as a hedge fund.

- Whereas Predictoor takes predictions, then aggregates them and sells the aggregate. It operates as data feeds.

Secondary differences:

- Numerai focus is tradfi trading, as a hedge fund.

- Whereas Predictoor is pure datafeeds, and applies to any vertical. Its first use case is defi trading.

- Currently Numerai is mostly centralized.

- Whereas Predictoor is decentralized. Predictoor tech may be useful to Numerai to help decentralize:)

Relation to Numerai Signals

Q: How does Predictoor compare to Numerai Signals? People supplying to Numerai Signals don’t get paid out from trading (like the main Numerai product).

A: They’re different:

- In Numerai Signals, payout is a function of the submitter’s “originality” compared to other signals. These signals are used as inputs for prediction models in Numerai main product.

- Whereas in Predictoor, payout is a function of the the accuracy of the submitter’s prediction, compared to the true value. These signals are predictions, directly.

Relation to IntoTheBlock Predict Predictions tool

Q: How does Predictoor compare to IntoTheBlock Price Predictions tool? Is has prediction feeds of crypto prices.

A: They’re different.

- The IntoTheBlock tool is run internally by IntoTheBlock, to build build centralized AI models that are served up via a REST API and a webapp

- You can view Predictoor as a “next-gen” version of that tool: a decentralized version that crowd-sources predictions.

– Crowd-sourcing with accuracy incentives has potential to do much better than any centralized approach. It doesn’t rely on the ideas of a single team; instead it makes the opportunity to predict open to anyone in the world. A perpetual data-science competition. The incentives mean that only the best will stick around. This will get reflected in the prediction feeds’ accuracies.

– Being decentralized means one doesn’t need to rely on a centralized actor running centralized services. Useful for anyone coming to rely on prediction feeds.

Finally, Predictoor’s ambition is broader: to extend beyond crypto into energy, weather, agriculture and more. It’s easier to expand scope of decentralized feeds, because you don’t need to spin up a new team to focus on each new vertical.

About Ocean Protocol

Ocean Protocol was founded to level the playing field for AI and data. Ocean tools enable people to privately & securely publish, exchange, and consume data.

The Ocean Protocol core team builds the Ocean Predictoor product.

About Oasis Network

The Oasis Network is a privacy-focused, scalable, Proof-of-Stake Layer-1 smart contract platform that is Ethereum Virtual Machine compatible. Oasis boasts a multi-layer modular architecture that enables the scalability and flexibility to deploy low-cost privacy-focused smart contracts toward Web3 ideals.

Oasis Network includes Oasis Emerald chain, and Oasis Sapphire chain. The latter is privacy-preserving via Trusted Execution Environments (TEEs).

Notes

[0] On testnet, the Predictoor bots run by Ocean core team make random predictions. When mainnet goes live, Predictoor bots run by core team are AI/ML-powered.

[1] They might have also exited earlier if price spiked (“take profits” action) or price was crashing (“stop loss” action).

[2] Submitting a “true” price value like this could also have been performed using a Chainlink setup (or otherwise). However we wanted to retain flexibility for feeds not currently on Chainlink, for now.

[3] The implementation is in templates/ERC20Template3.sol at at Ocean’s contracts repo.

Final Note

None of the content in this post should be taken as financial advice. Everything you do is your responsibility, at your discretion.

Updates

[Sep 20, 2023] Updated the dates for Predictoor Mainnet release and Predictoor DF, because the original dates were wrong. Mainnet is exactly 4 weeks after testnet, ie Oct 10 (not Oct 3). DF is 4 weeks + 2 days after Mainnet, ie Nov 9 (not Nov 2).

[Sep 20, 2023] Added more information about testnet & mainnet chains, bridges, and tokens.

[Nov 3, 2023] We’ve recently added simulations to the predictoor and trader onboarding READMEs. Accordingly, we updated the “how to earn” sections.

[Nov 3, 2023] It’s now less friction to just go to “Run a predictoor bot” directly; we don’t need Challenge DF anymore. So Challenge DF will wind down in early Dec 2023. We updated this post accordingly. This includes: in “How to Earn as a Predictoor” section, removed the Challenge DF step.

[Nov 13, 2023] Added section that compares to InTheBlock Price Predictions tool.

About Predictoor & Ocean Protocol

In Ocean Predictoor, people run AI-powered prediction bots or trading bots on crypto price feeds to earn $. Follow Predictoor on Twitter, and get support in discord. Track progress on GitHub at pdr-backend and more. Predictoor runs on Oasis Sapphire confidential EVM chain.

Predictoor is powered by Ocean Protocol, which provides tools to privately & securely publish, exchange, and consume data. Follow Ocean on Twitter or Telegram.